Table of Contents

As ONLINE COMSUMERS, we’re constantly bombarded with offers that promise us the world. “No Cost EMI” – these words are alluring, aren’t they? The idea of purchasing a product on easy monthly installments, without having to pay any interest, sounds like a dream come true.

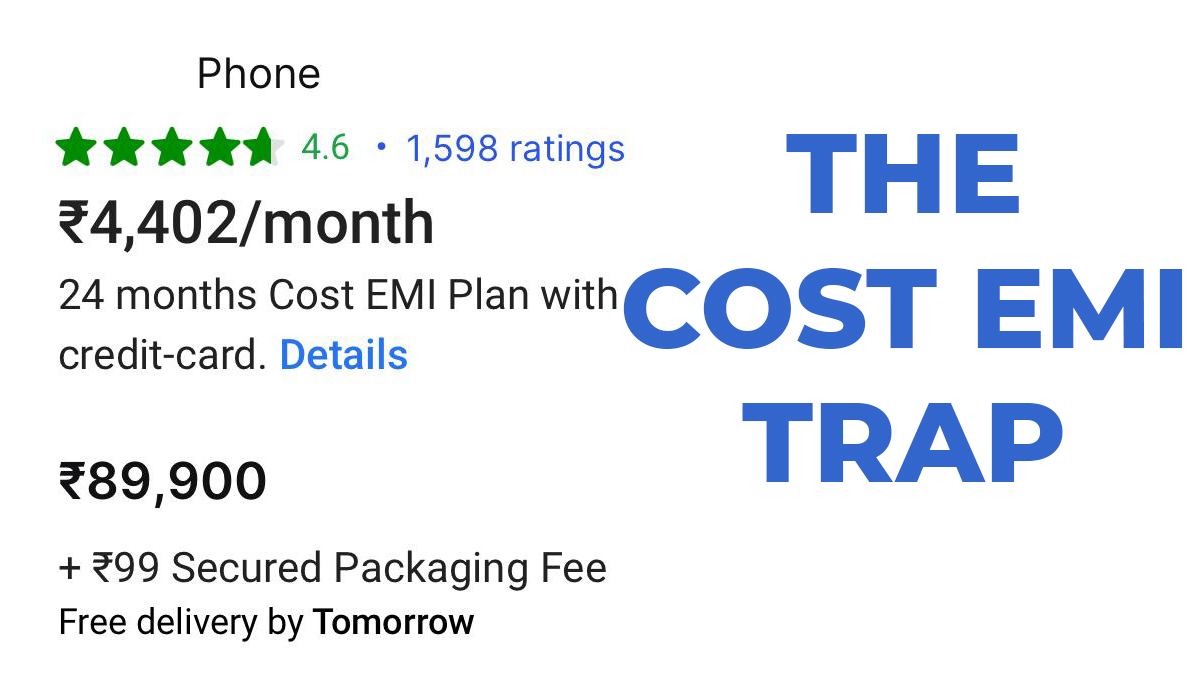

But before you get too excited and click on that tempting “Buy Now” button, there’s something you need to know. What many e-commerce sites are cleverly marketing as “No Cost EMI” might actually be a Cost EMI trap, and falling for it could cost you far more than you bargained for.

What is the Cost EMI Trap?

Here’s how it works: While browsing an online shopping portal, you come across a product you’ve been eyeing. On the payment page, you see an option for “Cost EMI,” but your brain quickly assumes that it’s the much-coveted “No Cost EMI” deal. It sounds too good to pass up, right? You assume that it means you can buy the product on easy monthly payments without any extra charges or interest.

However, as soon as you proceed to checkout and select the EMI option, you realize that the payment plan isn’t as straightforward as it seemed. What looked like a “no-cost” option now reveals hidden interest charges, processing fees, and sometimes even an inflated product price. Suddenly, the cost of your product has increased significantly, and you’re left wondering how it happened.

This, my friends, is the Cost EMI trap. It’s not that the installment option is a scam, but rather that it’s cleverly designed to deceive you. The words “No Cost EMI” and “Cost EMI” are being used so similarly that they become interchangeable in your mind, leading you to think you’re getting a great deal. In reality, the product is priced higher, and the EMI option is just a way for the e-commerce platform to trick you into believing you’re saving money.

GET 20% OFF ON ALL HOSTING PLANS!

Unlock 20% Off on All Hosting Plans with Hostinger!

Why Are They Doing This?

The primary reason online sellers use this type of deceptive marketing is simple: to boost sales and attract more customers. By using the phrase “No Cost EMI,” they’re tapping into the consumer psychology that loves the idea of purchasing something without paying any interest. But here’s the catch – they’re not really offering an interest-free deal at all. They’ve simply inflated the price of the product or added hidden fees to make it appear like you’re getting a “no-cost” deal.

When people see the term “No Cost EMI,” they get an immediate emotional response. The idea of paying for a product in installments without any additional costs feels like a great opportunity. But this tactic is nothing more than an illusion. It’s manipulative marketing that plays on our biases and our desire to save money.

What’s the Impact on Consumers?

If you’re not careful, you could easily end up paying more for a product than its original price, all because of the misleading “EMI” options. Not only will you be paying for the product over time, but you’ll also be saddled with additional costs like interest and processing fees. Over the course of several months, this could add up to hundreds or even thousands of rupees more than you originally intended to spend.

The worst part? The buyer is often unaware of these hidden costs until they’re already deep into the payment process. The damage has already been done, and at that point, canceling the order can be a hassle.

Is This Fair?

Absolutely not. This kind of marketing is deceptive and manipulative, taking advantage of consumers who are simply trying to make a well-informed purchase. It’s not just a case of poor transparency – it’s a deliberate tactic to mislead you into believing you’re getting a better deal than you actually are. Consumers deserve clear, honest, and upfront information, especially when it comes to something as important as the cost of a product.

By using misleading terminology like “No Cost EMI” when it’s really a “Cost EMI” plan, sellers are not giving consumers a fair chance to make informed decisions. And in some cases, this could even be considered false advertising.

What Can You Do to Protect Yourself?

As consumers, we need to be vigilant. Before clicking the “Buy Now” button, take a moment to read the fine print. Ensure that you understand exactly what your EMI plan entails – what the interest rate is, whether there are any hidden charges, and if the product price has been inflated to accommodate these fees.

Here are a few tips to avoid falling into the Cost EMI trap:

- Read all terms and conditions – Don’t just glance at the headline offer. Check the full details of the EMI option.

- Look out for hidden costs – Sometimes, the “No Cost EMI” phrase comes with additional processing fees that end up costing you more.

- Compare prices – Is the product price the same whether you pay upfront or through EMI? If it’s higher with EMI, you’re likely getting tricked.

- Look for reviews – See what others are saying about the product and whether they’ve fallen into the same trap.

- Trust your instincts – If it sounds too good to be true, it probably is.

Conclusion: The Cost EMI Trap Is a Form of Manipulative Marketing

The type of marketing that plays on consumer psychology by using deceptive terms like “No Cost EMI” is called “misleading marketing” or “manipulative marketing.” It’s designed to make you feel like you’re getting a great deal while actually paying more in the long run. This tactic might boost sales, but it’s unfair to consumers who deserve transparency in their buying decisions.

So, next time you see “No Cost EMI,” pause and take a closer look. Be cautious, be informed, and protect yourself from falling into the Cost EMI trap. Stay smart, stay skeptical, and always double-check the true cost before you commit to any online purchase.

- Brain Fog: Are you suffering with it? – June 9, 2025

- Are We Truly Developed? The Paradox of Modern Progress – April 21, 2025

- Destiny and Karma: Why We Must Work for What Is Destined – April 17, 2025

Leave a Reply