Category: FINANCE

-

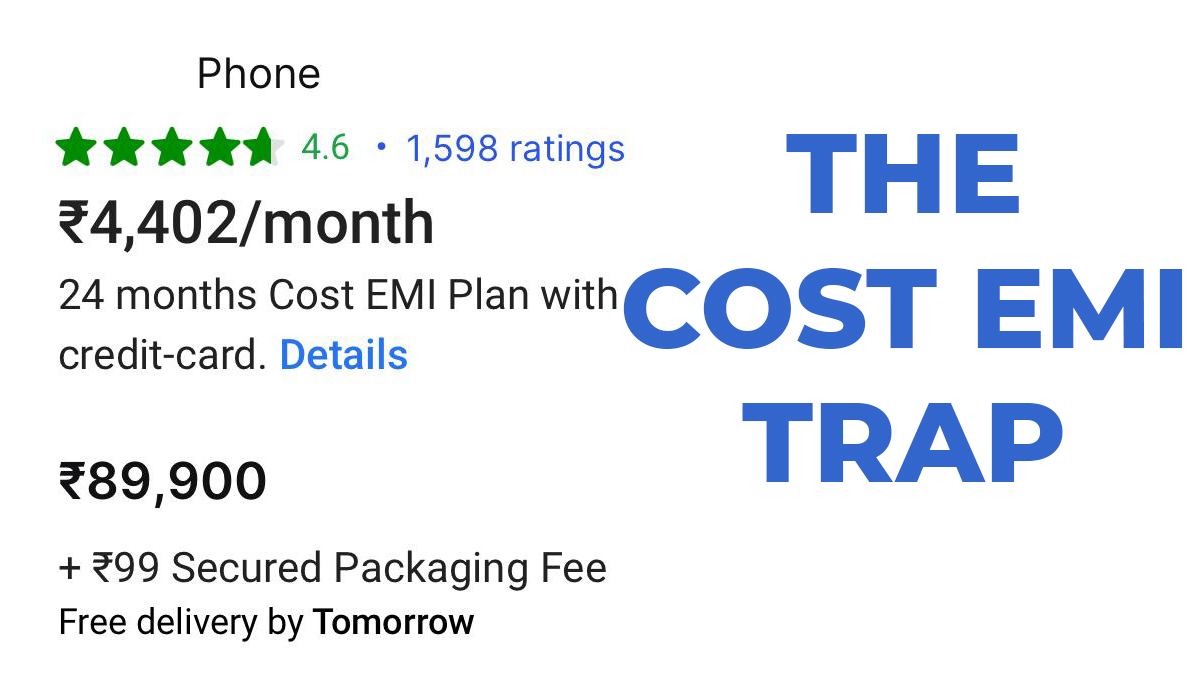

Beware of FOMO Marketing: The Deceptive Tactics Behind Unrealistic Online Offers

Have you ever clicked on an ad for an amazing product at an unbeatable price, only to find that when you reach the landing page, the price has mysteriously increased? Or worse, have you ever received an urgent email saying you need to act fast before the deal expires, only to realize that the original…

-

Mutual funds returns calculator

Mutual Funds Returns Calculator Initial Investment: Final Investment: Duration (in years): Calculate Returns Unlocking Your Mutual Funds Returns: A Step-by-Step Guide Investing in mutual funds can be a rewarding journey toward financial growth, and assessing the returns on your investments is key to understanding their performance. Our Mutual Funds Returns Calculator offers a simplified way…

-

PAY YOUR CAR LOAN WITHOUT INTEREST – USE THIS TRICK

Are you looking for a way to make your car loan effectively interest-free? The idea might sound ambitious, but it’s achievable with a smart financial strategy involving Systematic Investment Plans (SIPs). In this blog post, we’ll explore how you can utilize SIPs to offset the interest costs on your car loan and make your loan…

-

How to Save for a Car Down Payment Quickly

Buying a car is a significant financial milestone, and one of the best ways to make it more affordable is by saving for a substantial down payment. A larger down payment can reduce your monthly payments, lower your interest rate, and decrease the total amount you pay over the life of the loan. Here are…